One of the major advantages of property security mortgage and household re-finance app and you can recognition processes are quick and easy. Oftentimes the borrowed funds application should be accepted inside hours and perhaps the borrowed funds is going to be financed within the since the absolutely nothing just like the 48 hours in case the debtor demands the money quickly, in reality these financial could be one of an educated choices and choice offered by enough time.

In the example of one minute home loan, the word of this kind out-of domestic collateral loan is usually 1 year, while the term into the good HELOC could be unlock for the really area. One another choices is seen as the a benefit depending on how enough time out-of a term otherwise in short supply of an expression you would expect to require the brand new usage of loans.

Other secret benefit would be the fact with regards to family guarantee loans funded from the personal lenders, brand new borrower’s credit history and you may earnings dont enjoy a much bigger role for the deciding whether your debtor normally be eligible for the borrowed funds or perhaps not. If you are looking for the best family collateral loan rates you then might be necessary to has at least credit score and you can qualifying earnings to debt percentages, even when it’s still is actually a simpler process than just getting a first mortgage from a lender usually.

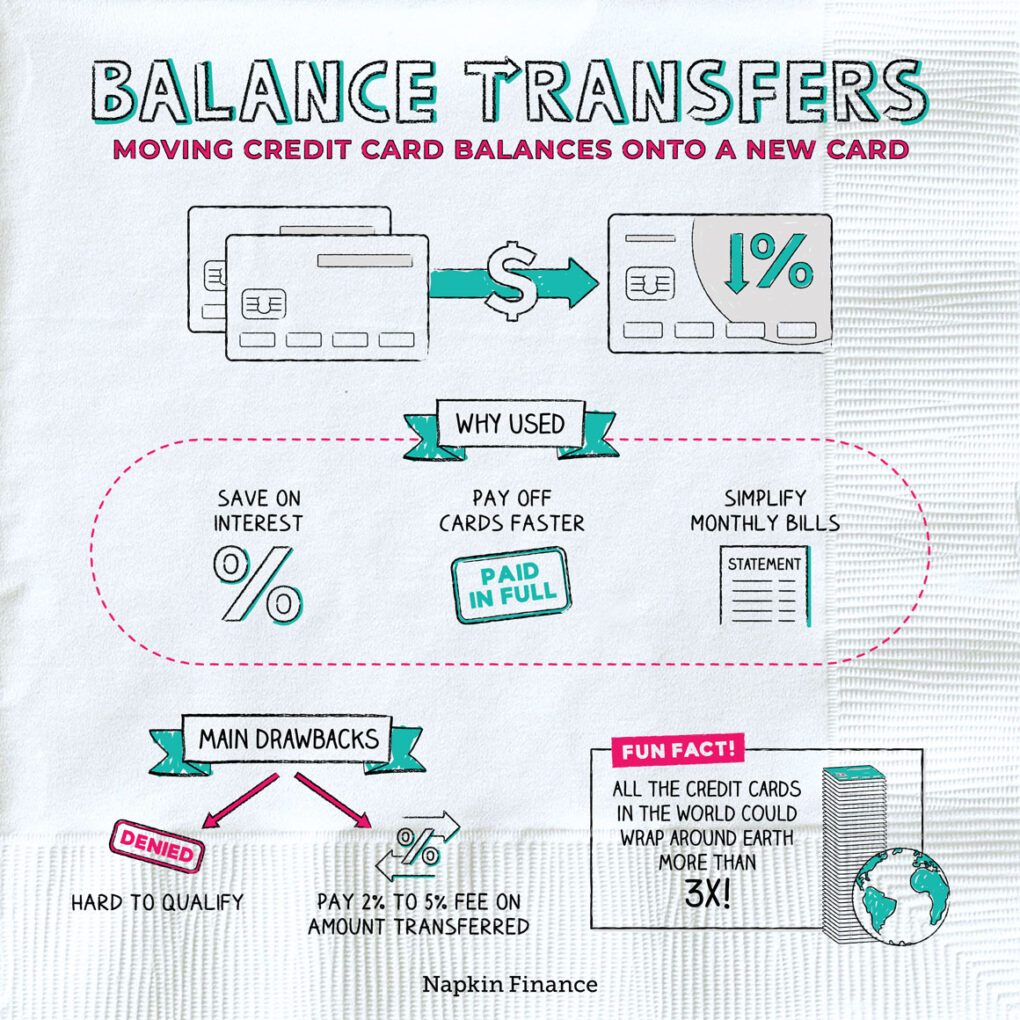

To the extra earnings which you have remaining at the bottom of any week, you can use you to definitely to pay on the principal quantity of the loan faster than just you’ll possess otherwise paid back you to definitely mastercard having a 20% interest

Yet another virtue whenever getting the correct home security loan is it can easily save you many and also thousands out-of bucks when the put because the a debt consolidation tool to consolidate costs that have highest fixed pricing. Credit cards, mall notes, do-it-yourself store handmade cards, are apt to have interest rates which might be somewhat higher than the new cost you might get with a decent brand new home guarantee financing.

Family guarantee financing normally have much lower rates than just a credit card, household repair shop cards, grocery otherwise gas cards, otherwise emporium card would. You don’t need to a beneficial calculator observe that you’ll be rescuing somewhat that have a property security mortgage during the six%, 7%, 8% or more.

What are the cons of house guarantee loans?

A few of the potential drawback out-of domestic security financing tend to be highest rates of interest in comparison to so much more traditions money covered once more an effective borrower’s home. Since these type of funds are in next otherwise third consideration behind an initial otherwise second financial otherwise household security collection of borrowing from the bank (also known as property range), lenders of domestic collateral finance charge a higher interest so you’re able to compensate for the additional economic visibility its capital provides.

Some other downside to property collateral loan ‘s the most lender charges, judge charges, and agent charge that come including this type of money that debtor has to account fully for. Once more as a result of the heightened monetary risk into the lenders, they typically charge a loan provider fee that can start from since low given that 0.5% so you’re able to as much as 10% occasionally in order to make upwards for most of the even more risk they just take. Plus, while the in the most common household collateral loan cases lenders do not afford the agents one thing, otherwise almost no in certain instances payday loans bad credit Redstone, the borrowed funds agent can add a fee which can as well as range of only 0.5% while increasing after that with respect to the difficulty of your own loan and you can amount borrowed. Its normal toward agent fee per cent to help you ount expands.